Cyfrowy Polsat shares

Shares of Cyfrowy Polsat are listed on the Warsaw Stock Exchange since May 6, 2008.

The table below presents the characteristics of the shares issued as of December 31, 2015:

| Series | Number of shares | Type of shares | Number of votes at the General Meeting | Face value/PLN |

|---|---|---|---|---|

| A | 2,500,000 | Preference shares (2 voting rights) | 5,000,000 | 100,000.00 |

| B | 2,500,000 | Preference shares (2 voting rights) | 5,000,000 | 100,000.00 |

| C | 7,500,000 | Preference shares (2 voting rights) | 15,000,000 | 300,000.00 |

| D | 166,917,501 | Preference shares (2 voting rights) | 333,835,002 | 6,676,700.04 |

| D | 8,082,499 | Ordinary bearer shares | 8,082,499 | 323,299.96 |

| E | 75,000,000 | Ordinary bearer shares | 75,000,000 | 3,000,000.00 |

| F | 5,825,000 | Ordinary bearer shares | 5,825,000 | 233,000.00 |

| H | 80,027,836 | Ordinary bearer shares | 80,027,836 | 3,201,113.44 |

| I | 47,260,690 | Ordinary bearer shares | 47,260,690 | 1,890,427.60 |

| J | 243,932,490 | Ordinary bearer shares | 243,932,490 | 9,757,299.60 |

| Total | 639,546,016 | 818,963,517 | 25,581,840.64 | |

| including: | 179,417,501 | Registered | 358,835,002 | 7,176,700.04 |

| 216,196,025 | Floating | 216,196,025 | 8,647,84.00 |

The current share capital of the Company is PLN 25,581,840.64, divided into 639,546,016 shares. At present, the total number of votes at the General Meeting is 818,963,517.

The shareholding structure as at the date of preparation of this Report together with a description of changes in the structure of ownership of significant number of shares of the Company in the period since the publication of the last periodic report are set forth in detail in item 8.4 –Corporate Governance Statement – Share capital and shareholding structure of Cyfrowy Polsat.

Basic data on the Cyfrowy Polsat shares in trading

| date of first quotation | May 6, 2008 |

|---|---|

| component of indices | WIG,WIG20, WIG30, WIG-MEDIA |

| market | main |

| quotation system | continuous |

| sector | media |

| International Securities Identification Number (ISIN) | PLCFRPT00013 (1) |

| Cyfrowy Polsat’s identification codes | |

| WSE | CPS |

| Reuters | CYFWF.PK |

| Bloomberg | CPS:PW |

(1) Shares admitted to trading on the WSE.

Cyfrowy Polsat shares on the stock exchange in 2015

| 2015 | 2014 | ||

|---|---|---|---|

| Year-end price | PLN | 20.88 | 23.50 |

| High for the year | PLN | 26.05 | 27.80 |

| Low for the year | PLN | 20.43 | 18.73 |

| Average for the year | PLN | 23.91 | 22.86 |

| Average daily turnover | PLN '000 | 10,585 | 9,966 |

| Average daily trading volume | shares | 444,522 | 439,978 |

| Number of shares (as at year-end) | shares | 639,546,016 | 639,546,016 |

| Bearer shares | shares | 216,196,025 | 216,196,025 |

| Market capitalization (as at year-end) | PLN '000 | 13,353,721 | 15,029,331 |

Market capitalization of Cyfrowy Polsat since its debut on the WSE (PLN)

In terms of market capitalization, that amounted to PLN 13.4 billion as of the end of 2015, Cyfrowy Polsat is the largest media and telecommunications company quoted on the Warsaw Stock Exchange and in Central Eastern Europe.

[gwtwidget|SeriesFromGrid;2|53|xlsxid=chart;GridId=Capitalization_Tab][gwtwidget|Chart_D;2|50|xlsxid=chart;LabelFormatter=#,##0.0##;Height=400;MarginBottom=80;MarginRight=50;PointWidth=40;Type=COLUMN;LabelEnabled=false;LabelEnabled_Column=true;Colors=#BFBFBF;LastColumnColor=#F7A833]

Recommendations

Brokers covering the Company:

| Local | International |

|---|---|

|

|

Recommendations for the shares of Cyfrowy Polsat published in 2015

| Date | Institution | Target price | Recommendation [PLN] | |

|---|---|---|---|---|

| December 18th | ING Securities S.A. | – | Hold | 23.20 |

| December 15th | DM PKO BP S.A | Buy | 26.60 | |

| December 15th | Goldman Sachs | – | Neutral | 23.60 |

| December 15th | Haitong Bank S.A. | Buy | 26.10 | |

| December 11th | IPOPEMA Securities S.A. | Buy | 27.20 | |

| December 3rd | DM mBanku S.A. | Reduce | 22.10 | |

| November 15th | Deutsche Bank Securities S.A. | – | Hold | 27.00 |

| October 27th | Citigroup Global Markets Inc. | – | Neutral | 25.80 |

| October 26th | Dom Maklerski BDM S.A. | – | Hold | 24.21 |

| October 19th | Dom Maklerski BZ WBK S.A. | Buy | 32.00 | |

| October 16th | ING Securities S.A. | – | Hold | 26.30 |

| October 16th | Trigon Dom Maklerski S.A. | Buy | 28.30 | |

| September 2nd | Wood&Company | Buy | 28.70 | |

| August 27th | Goldman Sachs | – | Neutral | 24.80 |

| July 22nd | Dom Maklerski BOŚ S.A | – | Hold | 25.00 |

| July 21st | Raiffeisen CENTROBANK | Buy | 28.50 | |

| July | ING Securities S.A. | Buy | 27.00 | |

| July 15th | Banco Espírito Santo de Investimento, S.A.(1) | Buy | 28.00 | |

| July 8th | Dom Maklerski BZ WBK S.A. | Buy | 31.50 | |

| May 25th | DM PKO BP S.A. | – | Hold | 27.90 |

| May 7th | ERSTE Group Research | Buy | 30.00 | |

| April 22nd | Dom Maklerski BZ WBK S.A. | Buy | 31.70 | |

| April 21st | Goldman Sachs | – | Neutral | 26.10 |

| March 26th | Raiffeisen CENTROBANK | Buy | 30.00 | |

| March 11th | Goldman Sachs | – | Neutral | 25.80 |

| March 12th | Trigon Dom Maklerski S.A. | Buy | 28.30 | |

| March 9th | UBS Investment Bank | Buy | 28.00 | |

| February 18th | Raiffeisen CENTROBANK | Buy | 29.00 | |

| February 17th | Goldman Sachs | – | Neutral | 27.30 |

| February 11th | Dom Maklerski BZ WBK S.A. | Buy | 31.10 | |

| February 10th | ERSTE Group Research | – | Hold | 26.00 |

| February 2nd | Trigon Dom Maklerski S.A. | Buy | 28.80 | |

| January 19th | IPOPEMA Securities S.A. | Buy | 26.70 | |

| January 19th | Dom Maklerski BDM S.A. | Reduce | 20.11 | |

| January 16th | Deutsche Bank Securities S.A. | – | Hold | 26.00 |

Recommendations released in 2016 until February 26, 2016

| Data | Institution | Recommendation | Target price (PLN) | ||||

|---|---|---|---|---|---|---|---|

| February 11th | Dom Maklerski BDM S.A. | Cumulate | 24.65 | ||||

| February 9th | IPOPEMA Securities S.A. | Buy | 24.00 | ||||

| February 2nd | DM mBanku S.A. | – | Hold | 22.10 | |||

| January 20th | Raiffeisen CENTROBANK | Buy | 26.50 | ||||

| January 13th | Deutsche Bank | Buy | 26.00 | ||||

(1) Currently Haitong Bank S.A.

A list of recommendations issued in 2016 after the reporting period is available on the website.

Recommendations structure as at February 26, 2016

Target price as at February 26, 2016 [PLN]

- minimum 22.1

- maximum 32.0

- average 26.3

Close dialogue with the capital market

Our corporate strategy aims to create sustainable value of the Company. We support this strategy through regular and open communication with all capital market participants.

In order to ensure current access to information we participate in conferences with investors, we organize numerous individual meetings and roadshows both in Europe and in the United States. Moreover, every quarter, after the publication of financial results, we organize periodical meetings with investors and sell-side analysts as well as teleconferences with the members of the Company’s management. Both events have an open character.

In communication with the capital market we are guided by the main principle of transparency and equal access to information. Following this principle, we introduced the rule of limited communication before the publication of our financial results. Under this rule the representatives of the Company do not discuss or meet with analysts and investors two weeks prior to the publication of the quarterly results. This rule is meant to increase transparency and ensure the equal access to information on the Company before the publication of our financial results.

Moreover, in our communications we use such tools as website dedicated to investors, electronic newsletters, RSS, periodic newsletters including both information on current events in the Company and latest market developments (press review), as well as reminders of the most important events in the Company.

Dividend policy

The Company intends to provide its shareholders with a share in the generated profit through the payment of dividends. When recommending the Company’s profit distribution scenario for a given financial year to which the new dividend policy will apply, the Management Board of the Company shall submit a proposal to the General Meeting for the distribution of dividends representing from 33% to 66% of the standalone net profit of the Company, provided that the total indebtedness ratio of the Company’s capital group, i.e. net debt to EBITDA as at the end of the financial year to which the profit distribution refers is less than 2.5x.

When preparing the recommendation for the distribution of the Company’s profit and the dividend payment, the Management Board will also take into consideration: the amount of standalone net profit achieved by the Company, the financial condition of the Company’s capital group, existing obligations (including any restrictions arising from financing agreements and indebtedness of the Company and other members of its group), the ability to use and manage capital reserves, the Management and Supervisory Boards’ assessment of the prospects of the Company and its capital group in a particular market situation, as well as the need to make expenditures in pursuit of the overriding goal of the Company, that is its continued growth, in particular through acquisitions and engaging in new projects. According to the resolution of the Management Board, the new dividend policy came into effect as of and first apply to the standalone net profit for the financial year ending December 31, 2014.

Acting in accordance with resolution no. 23 of the Ordinary General Meeting, held on April 2, 2015, regarding profit distribution, the Company’s total standalone net profit for the financial year ended December 31, 2014 in the amount of PLN 177.2 million was allocated to the reserve capital.

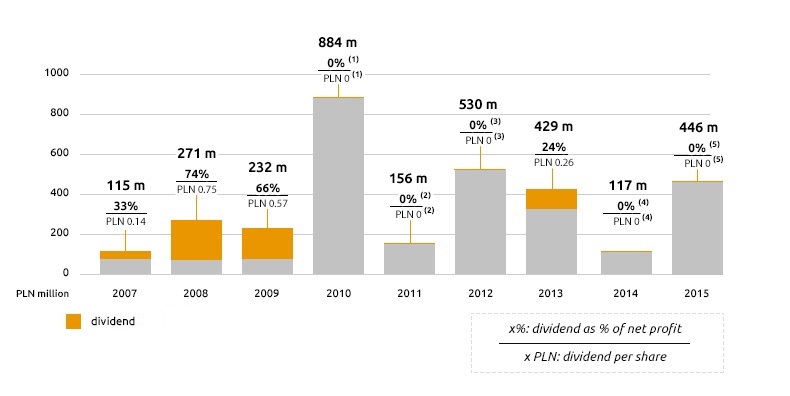

History of profit sharing

(1) Net profit allocated entirely to reserve capital according to the resolution of the General Meeting on May 19, 2011

(2) Net profit distributed in total to reserve capital and to cover losses from previous years according to the resolution of the General Meeting on June 5, 2012

(3) Net profit distributed in total to reserve capital according to the resolution of the General Meeting on June 11, 2013

(4) Net profit distributed in total to reserve capital according to the resolution of the General Meeting on April 2, 2015

(5) Net profit distributed in total to reserve capital according to the resolution of the General Meeting on June 29, 2016

Stock Chart