We are the leading integrated media and telecommunications group in the region

- We are the largest provider of pay TV services in Poland and a leading DTH provider in Europe in terms of the number of customers.

- Since 2006, we have been the leader of the Polish DTH market in terms of the number of active pay satellite TV, Internet access and telecommunication services, as well as their market shares.

- Our subsidiary, Polkomtel, focuses on the provision of mobile telecommunication services under the Plus brand and is one of the leading telecommunication operators in terms of the size of the contract base of mobile telephony and mobile broadband Internet access services.

- In 2015, we were the leading TV group in Poland in terms of growth dynamics of advertising revenues and audience shares, whereas our main channel, Polsat, maintained the position of the leader in terms of audience shares in that period.

- Our pay TV, telephony and Internet access services are sold through a distribution network with nationwide coverage. We have a total of 1.3 thousand stationary points of sale. We simultaneously offer our services in telemarketing, door-to-door channels, as well as online in our Internet store. Furthermore, Polkomtel has its own separate business customers sales and support channels, dedicated to serve specific groups of customers, as well as an extensive prepaid distribution network.

We have strong brand recognition and enjoy good reputation among our customers and viewers

- Cyfrowy Polsat, Polkomtel, Telewizja Polsat and IPLA brands are well recognized by Polish consumers and are associated with high quality and value-for-money services for the whole family.

According to a GfK Polonia survey, our Cyfrowy Polsat brand has the highest customer referral indicator of all pay TV operators in Poland. Plus is in turn the second brand on the voice services market most frequently recommended by customers.

(Net Promoter Score is an indicator which captures the differences between the share of people who would definitely recommend a given operator and the share of people who would not recommend a given operator – based on the “Satisfaction Survey” conducted by GfK Polonia in December 2015.)

In 2015, the report prepared by Millward Brown and commissioned by Media i Marketing Polska magazine, gave Polsat Media advertising sales office the highest score in the ranking of TV advertising sales offices in the field of cooperation for the second year in a row. In the above mentioned ranking, Polsat Media earned the highest scores in four out of eight dimensions: “general assessment of cooperation,” “fast and exhaustive response to a brief,” “I have trust in them – they offer me the feeling of security” and “they act flexibly and efficiently when changes occur in an advertising campaign”.

We have the largest customer base in Poland to which we up-sell a broad portfolio of services

Polsat Group has the largest base of unique customers, consisting of individual customers of Cyfrowy Polsat and Plus, business and corporate customers and prepaid users. This base includes 5.9 million of unique customers, bound by contracts for definite or indefinite periods of time, which entails the generation of regular monthly revenues. Our strategy assumes up-selling to this base of an extensive portfolio of telecommunication, television and other services by our companies, independently or in partnership with other entities, in order to increase revenues generated by unique customers. We believe that up-selling of services to our own base will enable us to increase the revenue in a cost-effective way, while simultaneously offering our customers attractive price terms, which should improve their satisfaction and loyalty.

We provide integrated services

Cyfrowy Polsat Group’s integrated multi-play services consist of pay DTH, Internet and telecommunication services. In addition, we offer our customers attractive, in terms of pricing, electricity supply services, the possibility of using banking, insurance, or telemedicine services.

We are the only pay DTH operator in Poland who provides full multi-play services, which is our significant competitive advantage on the pay DTH market in Poland. At the same time, we are the only telecommunication operator who offers multi-play services which include pay TV services provided with the use of own assets and infrastructure, which ensures higher price elasticity and more effective operating activities on the competitive market.

The integrated model of service provision enables us to offer attractive price terms to customers, while simultaneously simplifying the process of customer service, which should translate to higher customer satisfaction and loyalty. We believe that, similarly to the highly-developed European countries, preferences of the Polish population will be moving towards integrated services, which will strengthen our competitive advantage.

We are the leader of Internet access services in LTE technology

Internet access services relying on LTE technology offered by us are provided based on the unique, continuous 20 MHz block in the 1800 MHz frequency band. The quality of LTE services provided by us has been confirmed by numerous independent surveys and consumer tests, which indicated that our customers enjoy the fastest mobile Internet access in Poland. Most recently the above fact was also confirmed in a survey conducted by the telecom market regulator – the Office of Electronic Communications (UKE).

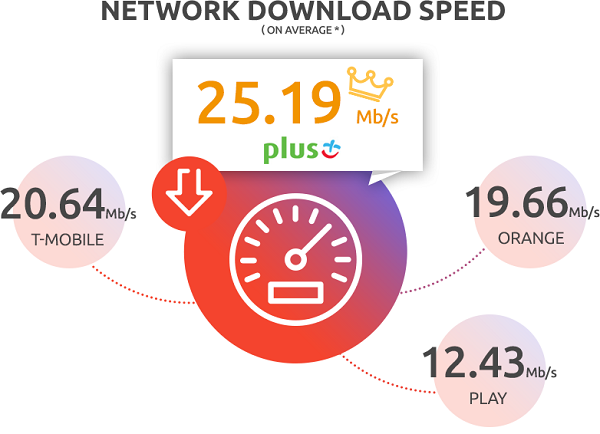

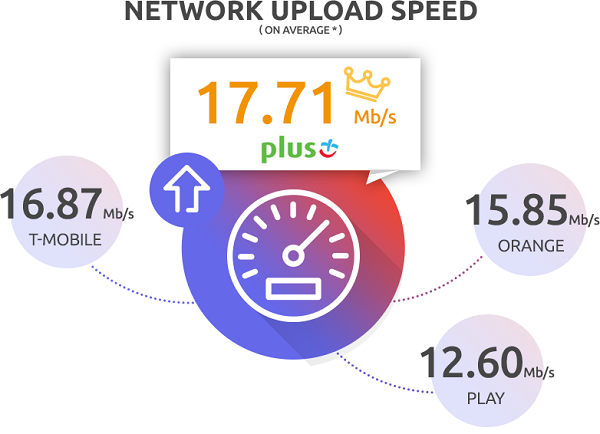

According to a UKE survey on the quality of mobile services, Internet access offered by Plus was the fastest in the category of data transmission, with the average download rate of 25.19 Mbps. That is two times faster than in the case of Play and 25% faster than in the case of T-Mobile and Orange. Data download rates for T-Mobile and Orange were respectively 20.64 Mbps and 19.66 Mbps, while for Play the result was 12.43 Mbps). In addition, Plus demonstrated the highest upload rate of 17.71 Mbps. In the case of other operators, the results were as follows: T-Mobile 16.87 Mbps, Orange – 15.85 Mbps, and Play – 12.60 Mbps.

The surveys also confirmed, indirectly, that Plus had the biggest LTE network coverage in Poland. LTE technology operated during as much as 94% of the duration of the tests related to Plus network.

The advantage of LTE technology over HSPA+ and UMTS is greater capacity and faster data transmission with smaller lags thanks to which users can freely enjoy interactive and multimedia services which require big throughputs and real time transmission, e.g. video communication, on-line gaming or HD TV over the Internet.

1 Report of a comparative survey of service quality indicators in mobile telecommunication networks in Poland, December, 2015

Multi-platform distribution of online video content and proprietary technology for internet content distribution

Our IPLA online video service makes us the only group in Poland to offer access to video content through a wide range of electronic devices, including computers/notebooks, tablets, smartphones, connected TV sets, set-top boxes, game consoles and home cinemas.

Our objective is to provide access to an extensive range of audio-visual content on any type of device for playing back online multimedia files. We strive to ensure that all types of platforms are supported by all major equipment manufacturers and operating systems.

We have also developed unique technological competencies in encoding and streaming of audio-visual content on the Internet, as well as in the field of optimizing the distribution of this type of signal. Thanks to the proprietary solutions applied to our IPLA online video platform, we are able to create services which are optimized for the limited Internet infrastructure in Poland and the capacities of external systems with which our applications are integrated. This way we may offer services of higher quality than the widely used solutions. For instance, our system of HD video stream encoding helps reduce the broadband required to deliver the signal by half compared to the solutions implemented by other operators on the Polish market.

Hence, the optimized technology has a direct effect on the success of our projects, increases their coverage potential and the number of concurrent viewers.

We control the process of production of set-top boxes

As the only operator on the Polish market, we produce our own set-top boxes. By the end of 2015 6.9 million high technology devices left our production line, out of which over 5.3 million were HD set-top boxes.

We control the entire process of production of set-top boxes, from the hardware and software design phase to the production in our own factory, as well as in our subcontractors’ facilities. This enables us to produce high quality set-top boxes while incurring manufacturing costs which are noticeably lower than the price of purchasing such equipment from external providers. The functionalities of our set-top boxes are designed in line with the customers' expectations gathered from surveys, thanks to which the equipment they get fully satifies their needs.

The broadest portfolio of TV channels in Poland is Polsat Group’s competitive advantage

- 32 channels including 10 channels offered in both, HD and SD quality,

- General entertainment, sports, news, lifestyle, movie and children’s channels,

- Attractive programming content, wide choice of movies and TV series, as well as entertainment programs based on our own concepts and on international formats,

- Contracts with major film studios, such as Sony Pictures Television International, 20th Century Fox, The Walt Disney Company or Warner Bros International TV Distribution,

- Wide range of sports coverage, including among others qualifying matches for UEFA European Championships France 2016, as well as UEFA Euro 2016 matches, qualifying matches for the 2018 FIFA World Cup, volleyball tournaments and many other sport disciplines.

High quality telecommunication infrastructure and broad radio spectrum

We provide telecommunication services through a high quality, state-of-the-art mobile network. Our network is an integrated 2G/3G/LTE network, based on which we provide voice services, data transmission, wholesale services and a broad portfolio of Value Added Services. We have spectrum reservations in an extensive portfolio of telecommunication frequencies, including 420, 900, 1800, 2100 and 2600 MHz bands. As a result, at present the coverage of our mobile services provided in 2G and 3G technology (including data transmission in HSPA+ technology) extends over nearly the entire population of Poland, with 96.8% of Poles being able to use the LTE technology.

Thanks to our mobile network we are able to provide our telecommunication services to the less populated suburban and rural areas of Poland at substantially lower cost than cable TV or fixed-line operators. This helps us to build a strong position in smaller cities and less urbanized areas of Poland and to provide telecommunication services – in a cost-effective way – to those customers of Cyfrowy Polsat, who mainly live in the aforementioned areas. Due to the high cost of network roll-out or launch of operations, as well as due to the regulatory barriers related to obtaining access to radio frequencies, we will continue to profit from our strong market position.

New entrants must overcome significant regulatory and operational barriers and acquire access to radio spectrum to compete effectively on the markets on which we operate

We believe that significant market entry barriers will enable us to maintain our leadership positions on the competitive Polish pay TV, telecommunication and TV broadcasting markets. Unlike potential new entrants to the Polish pay TV market, we benefit from economies of scale and a loyal customer base, and we can spread the relatively high cost of the technology necessary to provide the services over our large customer base and leverage the stronger bargaining power that comes with a leading market position. On the other hand, entry to the mobile telephony market requires direct access to telecommunication frequencies and very expensive and time-consuming investments into a telecommunication network, or obtaining paid access to the radio frequency via one of the four mobile operators. At present the vast majority of the radio spectrum allocated to mobile technologies has been nearly fully distributed among the current market players and a scenario assuming the emergence of a new infrastructural operator seems to be very unlikely. Operators who provide mobile services based on paid access to the existing mobile networks have so far failed to achieve the scale of business in Poland which could pose a significant competitive threat to us.

We have strong, stable and diversified cash flows

Our revenue is generated by two distinct revenue streams: the segment of the services provided to individual and business customers and the broadcasting and television production segment. In the segment of services provided to individual and business customers, our large customer base, revenues from subscription fees and the relatively low churn rate offer significant predictability of future revenues and strong recurring cash flows, which have historically proven to be resilient, even during periods of challenging economic conditions.

In the case of our cost base, we focus on improving efficiency while maintaining the high quality of provided services, e.g. by implementing initiatives aimed at developing in-house services and systems. Examples include our own set-top-box factory or the centralization of selected back-office processes within the entire Capital Group.

Experienced management team

Our management team consists of executives who have been members of management boards or served in other managerial positions within the media, TV and telecommunications industries and have extensive experience in these industries. In addition, our operations in both business segments are managed by teams of experienced senior managers, who provide expertise and deep understanding of the markets on which we operate. Our senior managers have a significant track record of increasing our customer base and market share, as well as launching new products in competitive environments while at the same time managing costs and increasing free cash flows.